Why Choose Bharti AXA Life Guaranteed Bachat Plan ?

Secure your dreams with Bharti AXA Life Guaranteed Bachat Plan — a unique life insurance savings plan that blends protection, flexibility, and guaranteed returns.

-

Financial security through insurance cover

Stay protected with life insurance cover throughout the policy term to ensure the financial security of your family and loved ones.

-

Customizable benefit structures

Enjoy the freedom to design your plan with a wide range of premium payment terms, deferment periods and income periods to suit your financial goals.

-

Flexible payout options

Choose how you receive your benefits — as a lump sum or as income, based on your financial goals and preferences.

-

Enhance protection coverage through optional riders

Opt for additional protection with our comprehensive range of riders.

-

Tax benefits as per prevailing tax laws2

You may avail the tax benefits on the premiums paid and the benefits received; subject to the prevailing tax laws. The tax benefits are subject to change as per change in Tax laws from time to time.

Key Benefits

Financial security through insurance cover

Customizable benefit structures

Flexible payout options

Enhance protection coverage through riders

Tax benefits as per prevailing tax laws

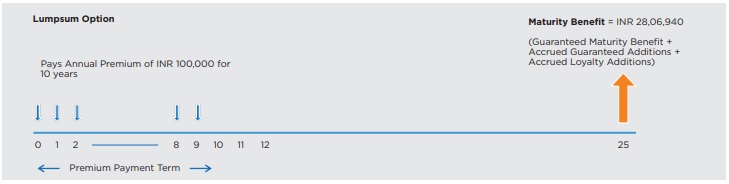

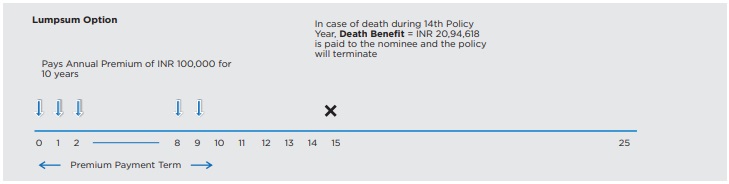

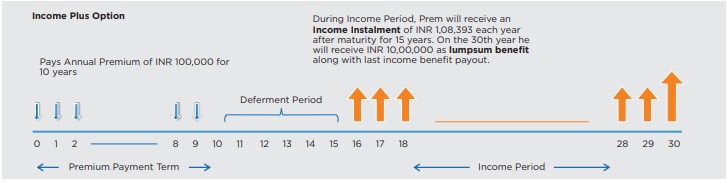

How Does the Plan Work?

^As lumpsum payout at the end of 20th year.

Make your plan with ease

Pick a plan option

Choose one of the options, as per your financial goals.

Lumpsum

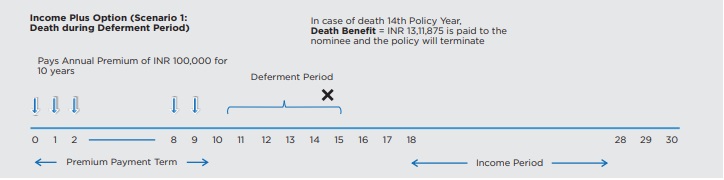

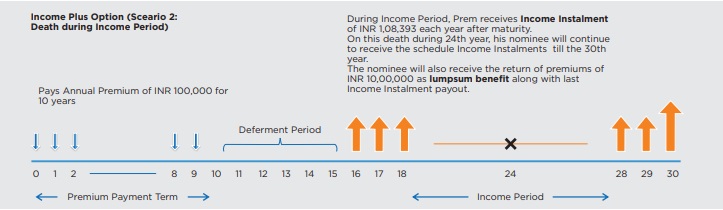

Income Plus

Lumpsum

Income Plus

Now, add a rider

The Bharti AXA Guaranteed Bachat Plan makes you feel good about life insurance.

The plan offers you the provision to buy additional peace of mind.

Bharti AXA Life Term Rider (130B009V03):

Under this rider the policyholder can increase the life insurance coverage for a nominal premium.

Bharti AXA Life Hospi Cash Rider (UIN: 130B007V05):

This rider allows payment of a fixed benefit for each day of hospitalization subject to maximum of 40 days per year and also provides lump sum benefit in case of surgery.

Bharti AXA Life Premium Waiver Rider (UIN: 130B005V05):

Under this rider, in case the Life Insured is diagnosed from any of the 11 critical illnesses covered under the rider, the future premiums are waived off and the benefits under the policy will continue.

Bharti AXA Life Non Linked Complete Shield Rider (UIN: 130B011V02):

Receive additional sum assured chosen under the rider in case of happening of a covered event.

Your Questions Answered

How do I know my ideal Sum Assured?

The ideal income for your chosen Sum Assured is showed in the premium box. Depending on your income status you can either increase or decrease your Sum Assured.

What will be the difference if I take the policy from an aggregator?

There is no difference. Web aggregators just advertise the benefits of Bharti AXA Life products on their website. All applications for purchasing the policy are directly routed to the Bharti AXA Life website. A customer cannot directly purchase the policy from an aggregator.

I do not have my policy details readily available with me either for Bharti AXA Life or for any other Insurance Company.

We suggest you save the data entered till now & collect the information requested for completing this information. Any non-disclosure can have a direct impact on your application.

Insurance Jargon Explained

Maturity benefit

It is the amount which the insurance company pays to the policy holder in the manner as specified in the Policy Bond, on the completion of the Policy Term, if the Life Insured has survived the entire duration of the Policy.

Riders

It is an additional benefit or coverage that you can add to your base insurance policy. These add-ons provide extra protection and coverage beyond what's included in your base policy

Premium

The payment, or one of the regular periodic payments, that a policyholder makes to an insurer in exchange for the insurer's obligation to pay benefits upon the occurrence of the contractually-specified contingency (e.g., death).

Sum Assured

Sum assured is the amount that an insurer agrees to pay on the occurrence of a stated contingency (eg: Death).

- Life Insurance Coverage is available under this policy.

- Bharti AXA Life Insurance Company Limited is the name of the Company and Bharti AXA Life Guaranteed Bachat is only the name of the non-linked, non-participating individual savings life insurance plan and does not in any way represent or indicate the quality of the policy or its future prospects.

- This product brochure is indicative of the terms, conditions, warranties and exceptions contained in the insurance policy bond.

- Policyholder and Life Insured may be different in this product.

- 2Tax benefits are as per the Income Tax Act, 1961, and are subject to any amendments made thereto from time to time

-

#For 30 Year Old Male, Endowment Plan Option, online purchase of policy excluding underwriting extra premium.

-

^As lumpsum payout at the end of 20th year.

-

$Terms and Conditions Apply.

-

*Guaranteed- Subject to Survival of the Life Insured, the Policy is in force and all due premiums have been paid.