Why Bharti AXA Life Guaranteed Wealth Pro is the right choice for you?

At Bharti AXA Life, we understand the importance of not only saving for the future but also ensuring that the future is safe in case of any unfortunate event. That is why we present to you Bharti AXA Life Guaranteed Wealth Pro - a Life Insurance plan that offers life insurance coverage along with an opportunity to save for your future. The product is designed to protect your family's financial security to ensure that they lead their lives comfortably without any financial worries, even in your absence.

-

Guaranteed Financial Returns

The plan offers you Fully guaranteed benefits to help you save for your milestones, provided all due premiums have been paid and policy is in force.

-

Secure your Financial Obligations

Fulfil your financial goals and obligations – whether for child needs (such as Education and Marriage), retirement, a holiday or just planning a supplementary income for your family.

-

Flexibility to Choose the Payout Structure

Bharti AXA Life Guaranteed Wealth Pro offers you the option to choose from the Endowment as well as Income options. Both the options provide guaranteed benefits based on your personal choice and needs to that ensure you overcome even the most uncertain times.

-

Multiple Income Options

The Income option gives you various options to choose from, viz. deferred income (which offers short-term, long-term and life-long income options post completion of premium payment term) as well as Early income (which offers you the choice of short-term and long-term income options beginning from the second policy year itself).

-

Life Insurance Cover

The product offers life insurance cover for the financial security of your family and loved ones. Apart from the in-built cover, you can get added protection through additional rider(s) that can be taken with the policy. Please note that riders are not mandatory and available at an additional cost.

-

Tax Benefits

You may be eligible for the tax benefits on the premiums paid along with the benefits received, subject to the prevailing tax laws. The tax benefits are subject to change as per change in Tax laws from time to time.

Key Benefits

Multiple Payout Options

Enhanced Protection

Tax Benefits

Flexibility in Policy Terms

Lifelong Income till age 100

Return of Premium1

^As lumpsum payout at the end of 20th year.

How Does the Plan Exactly Work?

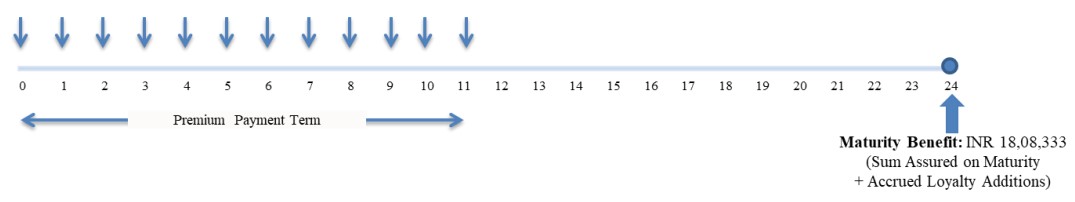

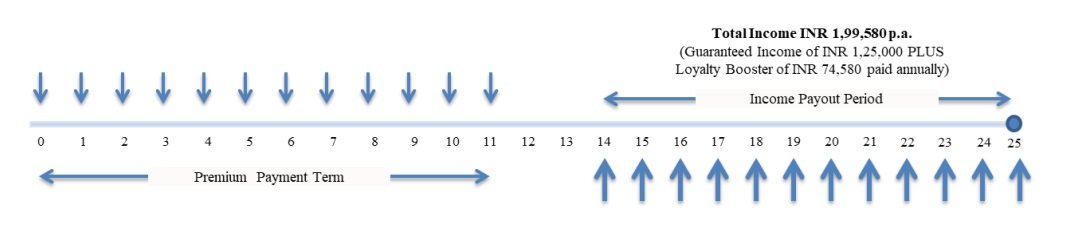

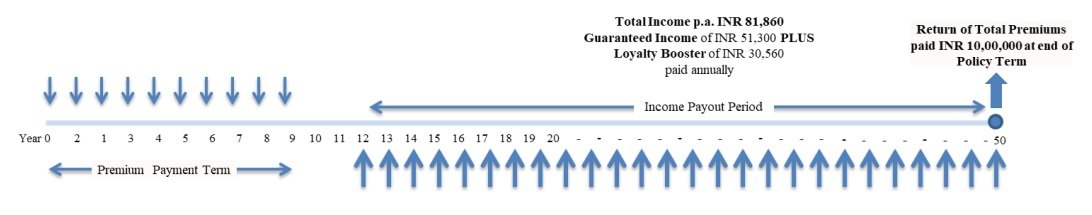

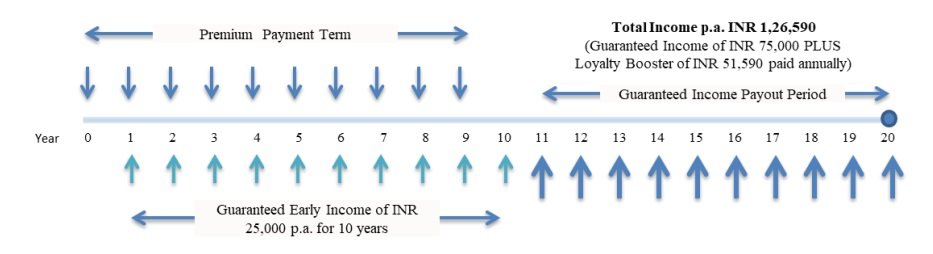

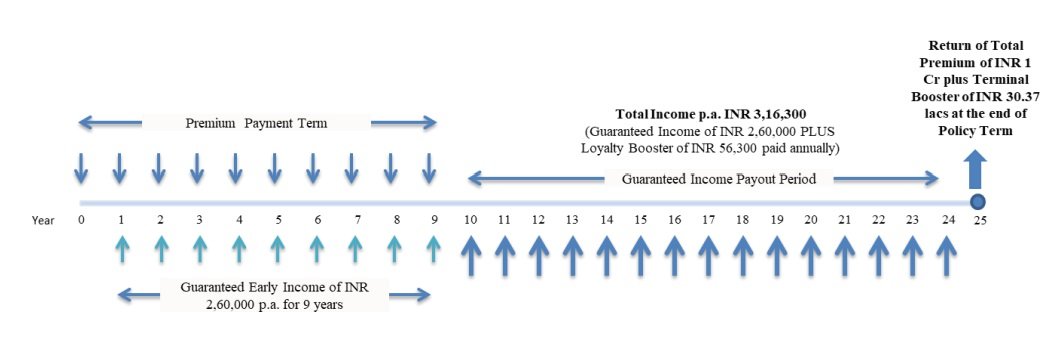

Following illustrative scenarios will help you understand different options offered by Bharti AXA Life Guaranteed Wealth Pro:

^As lumpsum payout at the end of 20th year.

Make your plan with ease

Pick a plan option

Choose one of the options, as per your financial goals.

Endowment option

Offers lumpsum payment on maturity

- If you wish to save for a special life goal such as child’s higher education or marriage, buying a house etc.

- This option offers guaranteed lump sum returns on your hard-earned money.

Short Term Income

Income payable is the sum of Guaranteed Income & Loyalty Booster

Long Term Income

Income payable is the sum of Guaranteed Income & Loyalty Booster

Life Long Income

Income payable is the sum of Guaranteed Income & Loyalty Booster

Early Income

Income payable is the sum of Guaranteed Early Income, Guaranteed Income & Loyalty Booster

Long Term Early Income

Income payable is the sum of Guaranteed Early Income, Guaranteed Income & Loyalty Booster

Endowment option

Offers lumpsum payment on maturity

- If you wish to save for a special life goal such as child’s higher education or marriage, buying a house etc.

- This option offers guaranteed lump sum returns on your hard-earned money.

Short Term Income

Income payable is the sum of Guaranteed Income & Loyalty Booster

Upon survival of the life insured at the time of income payment provided the policy is in-force and all due premiums have been paid, the income payable under this option shall be the sum of Guaranteed Income & Loyalty Booster.

Guaranteed Income (defined as a % of Annualized Premiums) is the income payable during the Income Payout Period.

Loyalty Booster (defined as a % of Annualized Premiums) is the additional income payable during the Income Payout Period.

Long Term Income

Income payable is the sum of Guaranteed Income & Loyalty Booster

Upon survival of the life insured at the time of income payment provided the policy is in-force and all due premiums have been paid, the income payable under this option shall be the sum of Guaranteed Income & Loyalty Booster.

Guaranteed Income (defined as a % of Annualized Premiums) is the income payable during the Income Payout Period.

Loyalty Booster (defined as a % of Annualized Premiums) is the additional income payable during the Income Payout Period.

Life Long Income

Income payable is the sum of Guaranteed Income & Loyalty Booster

Upon survival of the life insured at the time of income payment provided the policy is in-force and all due premiums have been paid, the income payable under this option shall be the sum of Guaranteed Income & Loyalty Booster.

Guaranteed Income (defined as a % of Annualized Premiums) is the income payable during the Income Payout Period.

Loyalty Booster (defined as a % of Annualized Premiums) is the additional income payable during the Income Payout Period.

Early Income

Income payable is the sum of Guaranteed Early Income, Guaranteed Income & Loyalty Booster

Upon survival of the life insured at the time of income payment provided the policy is in-force and all due premiums have been paid, the benefits payable under this option shall be the sum of Guaranteed Early Income, Guaranteed Income, and Loyalty Booster.

Guaranteed Early Income (defined as a % of Annualized Premium) is payable starting from the beginning of the 2nd Policy Year (post payment of second year’s premium(s)), in line with the Guaranteed Early Income Payout Period.

Guaranteed Income (defined as a % of Annualized Premiums) is the income payable during the Income Payout Period.

Loyalty Booster (defined as a % of Annualized Premiums) is the additional income payable during the Income Payout Period.

Long Term Early Income

Income payable is the sum of Guaranteed Early Income, Guaranteed Income & Loyalty Booster

Upon survival of the life insured at the time of income payment provided the policy is in-force and all due premiums have been paid, the benefits payable under this option shall be the sum of Guaranteed Early Income, Guaranteed Income, and Loyalty Booster.

Guaranteed Early Income (defined as a % of Annualized Premium) is payable starting from the beginning of the 2nd Policy Year (post payment of second year’s premium(s)), in line with the Guaranteed Early Income Payout Period.

Guaranteed Income (defined as a % of Annualized Premiums) is the income payable during the Income Payout Period.

Loyalty Booster (defined as a % of Annualized Premiums) is the additional income payable during the Income Payout Period.

Now, add a rider

The Bharti AXA Life Guaranteed Wealth Pro makes you feel good about life insurance. The plan offers you the provision to buy additional peace of mind.

Bharti AXA Life Term Rider (UIN: 130B009V03):

Under this rider the policyholder can increase the life insurance coverage for a nominal premium.

Bharti AXA Life Hospi Cash Rider (UIN: 130B007V05):

This rider allows payment of a fixed benefit for each day of hospitalization subject to maximum of 40 days per year and also provides lump sum benefit in case of surgery.

Bharti AXA Life Premium Waiver Rider (UIN: 130B005V05):

Under this rider, in case the Life Insured is diagnosed from any of the 11 critical illnesses covered under the rider, the future premiums are waived off and the benefits under the policy will continue.

Bharti AXA Life Non Linked Complete Shield Rider (UIN: 130B011V02):

Receive additional sum assured chosen under the rider in case of happening of a covered event.

Your Questions Answered

How do I know my ideal Sum Assured?

The ideal income for your chosen Sum Assured is showed in the premium box. Depending on your income status you can either increase or decrease your Sum Assured.

What will be the difference if I take the policy from an aggregator?

There is no difference. Web aggregators just advertise the benefits of Bharti AXA Life products on their website. All applications for purchasing the policy are directly routed to the Bharti AXA Life website. A customer cannot directly purchase the policy from an aggregator.

I do not have my policy details readily available with me either for Bharti AXA Life or for any other Insurance Company.

We suggest you save the data entered till now & collect the information requested for completing this information. Any non-disclosure can have a direct impact on your application.

Insurance Jargon Explained

Sum Assured

Sum assured is the amount that an insurer agrees to pay on the occurrence of a stated contingency (eg: Death).

Maturity Benefit

It is the amount which the insurance company pays to the policy holder on the completion of the Policy Term, if the Life Insured has survived the entire duration of the Policy. This amount includes the guaranteed sum of money called as Sum Assured on Maturity and also the Accrued Bonuses, if applicable.

Coverage

The amount of protection provided to the Policyholder on the basis of premium amount and the terms of the policy.

Rider

A provision attached to a policy that adds benefits not available in the original policy or that changes the original policy.

Riders help the Policyholder in enhancing the insurance product to meet specific needs by adding protection benefits to the basic Insurance Plan at a lower additional cost. For example, Bharti AXA Life Hospi cash rider provides fixed per day cash benefit to the Policyholder for each day of hospitalisation, thus providing benefits of a health plan along with base Life Insurance plan.

#For 30 Year Old Male, Endowment Plan Option, online purchase of policy excluding underwriting extra premium.

1Applicable for Life Long Income, Long Term Income and Long Term Early Income.

^As lumpsum payout at the end of 20th year.

*Terms and Conditions Apply.

*Guaranteed- Subject to Survival of the Life Insured, the Policy is in force and all due premiums have been paid.