Why Bharti AXA Life Swabhimaan Retirement Plan is the right choice for you?

Bharti AXA Life Swabhimaan Retirement Plan gives you an opportunity to get a guaranteed lifetime income after your retirement. You can start saving up for your old age by paying premiums over the years without burdening yourself with financial constraints. A retirement plan helps you :

1. Be financially independent

2. Enjoy your post-retirement life without worry

3. Take care of any unexpected expenses

With the Bharti AXA Life Swabhimaan Retirement Plan, you have the choice to map out early for your retirement and lock annuity rates at present for a guaranteed life-long payment. With its simple and easy-to-understand features, this plan is the perfect retirement plan for you.

Key Benefits

Guaranteed# lifetime income

Option to avail liquidity in financial exigencies&

Wide range of annuity options

Multiple Annuity Pay-out Frequencies

Decide when you want the annuity to start

Option to pay the purchase price as a Single Premium or spread over a few years

Option to receive annuity payments as long as you or your partner are alive*

Personalize your annuity payout date with our Save the date feature

How Does the Plan Exactly Work?

The Bharti AXA Life Swabhimaan Retirement Plan is extremely easy to understand and comprises of six steps that include:

Your Questions Answered

Will I get the policy benefits if my policy lapses?

No, you will lose the expected insurance benefits if your policy lapses.

Note: In life insurance, the grace period is the specific additional time you get after the premium due date is over to pay the premium and avoid policy lapse.

If I cannot pay the premium after a certain time due to some financial constraints, will I lose the policy?

In the case of regular/limited premium paying policies, if you are unable to pay further premiums after the completion of two policy years, your policy gets converted into paid-up unless revived. In this case, all your benefits will be reduced but the policy remains in force.

I forgot to pay the premium, will I lose the policy?

In case the premium is not paid by the due date, a grace period of 15 days will be given to you for the payment of the due premium for monthly frequency. A 30 days grace period is given for the due premium for quarterly, half-yearly and annual frequencies. You may pay the same during the grace period without any penalty or late fees. The policy continues during this grace period but will nullify post that.

Insurance Jargon Explained

Annuity

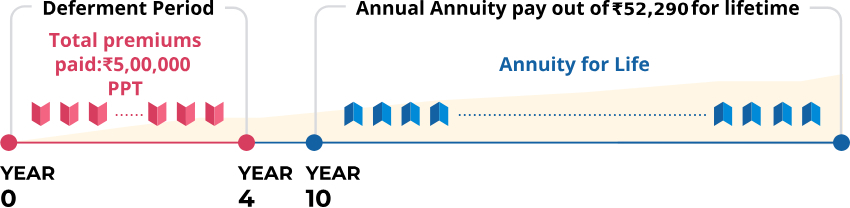

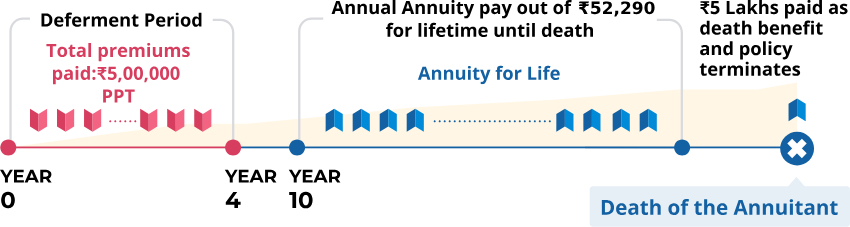

Annuity is a series of guaranteed income paid at specified regular intervals throughout the life of the Annuitant until his/her death. It is paid either immediately or after a deferment period.

Deferment period

Deferment Period means the number of years from the Date of Inception of Policy after which the Annuity payout will begin For eg – if the deferment period is 10 years, Annuity payout will start after 10 years of policy inception.

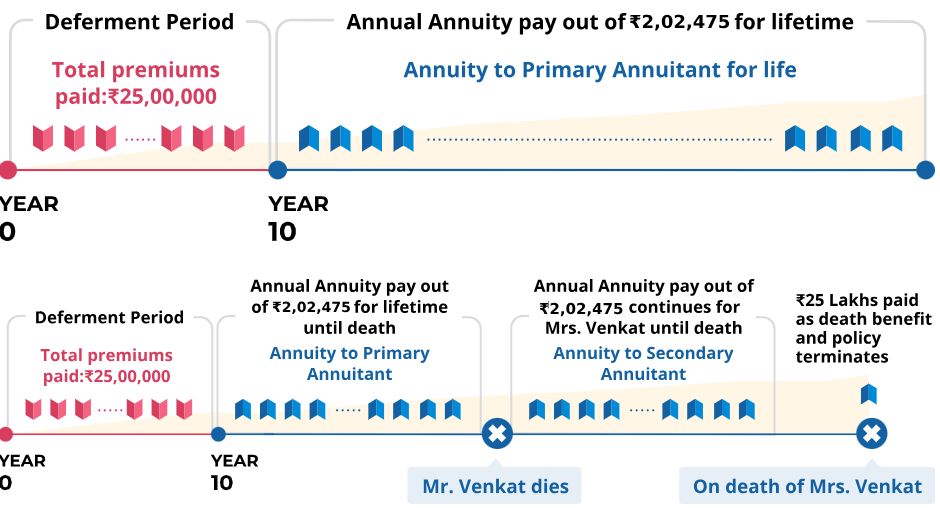

Joint Life annuity refers to an annuity policy taken jointly on the lives of Primary Annuitant and Secondary Annuitant. There has be to an insurable interest between the Annuitant(s)

Primary Life/ Annuitant (applicable under Joint Life Annuity Option) is the person on whose life this Policy has been taken and who is entitled to receive the annuity benefits

Secondary Life/ Annuitant (applicable under Joint Life Annuity Option) is the person entitled to receive the Annuity payment, in the event of death of the Primary Life/ Annuitant. The Secondary Life/ Annuitant must have an insurable interest with the Primary Life/ Annuitant.

Premium

Premium is defined as the amount paid by the policyholder to secure the benefits under the policy. It is the amount that the insured person pays to his/her insurer. And the frequency of paying the premium differs as well. It can be paid in five different ways. It can either be paid monthly, quarterly, semiannually, annually or you can pay it all at once, in a single payment.

Surrender Value

It is the amount of money a policyholder will be able to receive when they try to access the cash value or the account value of their policy. But this amount can only be accessible when the policyholder decides to terminate the policy before it matures by surrendering it.

Non-Forfeiture Benefits

It is also known as surrender benefit or paid-up benefit. This happens when the policy lapses due to the missed payments of the premium or also when the policyholder surrenders the policy.

#Provided policy is in force and all due premiums have been paid.

*Available under Joint Life Options. Conditions Apply

&Available under options offering Return of Premium on Death