Why Bharti AXA Life Monthly Advantage is the Right Choice?

It is a plan that gives you the flexibility to choose your Policy Term and Premium Payment Term from 3 options. It makes sure you receive a steady stream of monthly income without staying invested in the plan for a very long time. Life Insurance coverage is available under this product.

- Guaranteed Monthly Income

You start receiving Guaranteed Monthly Income after the completion of the Premium Payment Term, until Maturity, provided the policy is in force. You have the flexibility to choose the Monthly Income you wish to receive, which decides your Premium amount.

- Potential Upside through Bonuses

Non-Guaranteed Simple Annual Reversionary Bonuses (if declared) get accrued to the policy from the end of 1st policy year and get paid out on Maturity, Death or Accidental Total Permanent Disability. You may also receive Non-Guaranteed terminal bonus (if declared).

- Death or Accidental Total Permanent Disability (ATPD) Benefit

In case of the unfortunate event of Death or Accidental Total Permanent Disability of the Life Insured, the Monthly Income is payable to the nominee from the next policy month onwards and continues for the next 6, 8 or 12 years depending on the Policy Term option chosen at inception of the policy.

- Tax Benefits

Tax benefit for premiums paid and benefits received, are as per the prevailing tax laws which are subject to changes.

Key Benefits

Limited Pay Options

Maturity Benefit

Annual Reversionary Bonuses

Death Benefit

Accidental Total Permanent Disability Benefit

Survival Benefit

Tax Benefits**

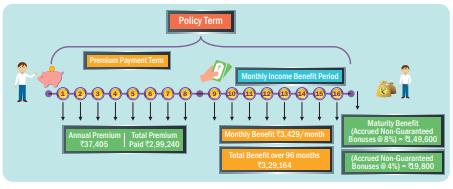

How Does the Product Work?

Make Your Plan with Ease

Pick a Policy Term

Choose one of the options, as per your financial goals.

12 years

Premium payment term: 6 years

16 years

Premium payment term: 8 years

24 years

Premium payment term: 12 years

12 years

Premium payment term: 6 years

16 years

Premium payment term: 8 years

24 years

Premium payment term: 12 years

Now, Add a Rider

You may enhance your protection under this Plan by opting for the following rider(s)

Bharti AXA Life Hospi Cash Rider (UIN:130B007V05):

This rider allows payment of a fixed benefit for each day of hospitalisation. It also offers a fixed amount benefit if you are admitted in an Intensive Unit Care or a lump sum benefit in case of surgery.

Bharti AXA Life Term Rider (UIN: 130B009V03):

Under this rider the policyholder can increase the life insurance coverage for a nominal premium.

Please refer to the rider brochure for complete details on terms and conditions and exclusions before opting for the rider. Riders are optional and are available at an extra cost.

Bharti AXA Life Non Linked Complete Shield Rider (UIN 130B011V02):

Under this rider, benefits can be received for accidental death, accidental total and permanent disability, accidental permanent and partial disability, standard critical illnesses, comprehensive critical illnesses and cancer care.

Insurance Jargon Explained

Maturity Benefit

It is the amount which the insurance company pays to the policy holder on the completion of the Policy Term, if the Life Insured has survived the entire duration of the Policy. This amount includes the guaranteed sum of money called as Sum Assured on Maturity and also the Accrued Bonuses, if applicable.

Insurability

Insurability refers to all conditions pertaining to individuals seeking insurance; that affect their health, susceptibility to injury and life expectancy; an individual's risk profile.

Premium

The payment, or one of the regular periodic payments, that a policyholder makes to an insurer in exchange for the insurer's obligation to pay benefits upon the occurrence of the contractually-specified contingency (e.g., death).

Sum Assured

Sum assured is the amount that an insurer agrees to pay on the occurrence of a stated contingency (eg: Death).

**Tax benefits are in accordance to current tax laws that are subject to change from time to time.